Even though leases typically comprise a major piece of a business’ budget, most companies don’t know how much their leases cost and many are unsure about how to account for them under the new rules.

Nearly three-quarters (71%) of private companies are not entirely confident they know how much their leases cost their business, according to a study released Monday by the Visual Lease Institute. That lack of awareness and visibility is one of the main reasons why companies are slow to transition to the new lease accounting standard from the Financial Accounting Standards Board known as ASC 842. One-third (33%) of private companies still aren’t fully prepared to transition to ASC 842, which has taken effect for 2022 and 2023 financial statements, according to the study, which surveyed 200 senior finance and accounting professionals. Public companies had to make the transition in 2019 to the new standard, which puts operating leases on the balance sheet of many companies for the first time.

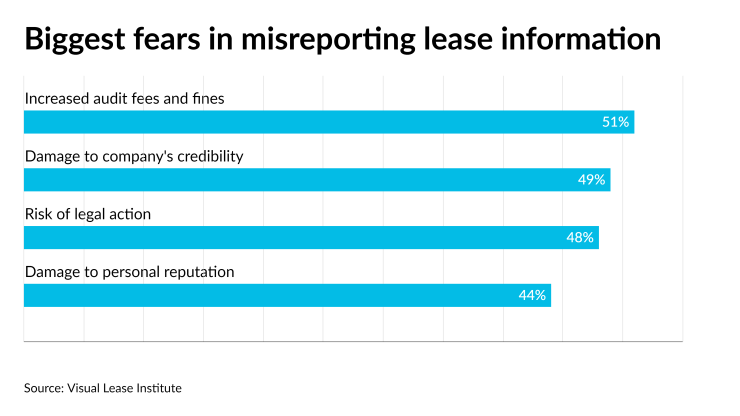

Executives are also worried about making errors, with 99% of the senior finance and accounting professionals surveyed at private companies acknowledging fears about potentially misreporting company lease information. Their concerns include increased audit fees and fines (51%), damage to a company’s credibility (49%), the risk of legal action (48%) and damage to their own personal reputation (44%).

The Governmental Accounting Standards Board has also released its own updated leases standard, GASB 87, for state and local governments. Its effective date was delayed until June 15, 2021, due to the pandemic. Even though it has technically taken effect, the study found a delay appears to be emerging in implementation of the standard. Forty-four percent of the government market is not fully prepared to transition to GASB 87 and only 18% of government institutions are at a point where they are considering lease accounting maintenance beyond initial compliance. In addition, nearly one-fourth of government entities aren’t aware of another impending GASB standard, GASB 96, which will affect how governmental organizations report on their subscription-based information technology agreements for fiscal years beginning after June 15, 2022.

“For years, companies may have been able to get away with loosely managing and tracking their leases, but that is no longer the case with new lease accounting standards, which require leased assets to be reflected on the balance sheet,” said Visual Lease CEO Marc Betesh in a statement. “In addition to these new standards, the global economic climate is creating additional concerns around implementing proper internal controls and lease management processes.”

Besides the pandemic, workforce shortages and retention issues have been causing private companies and government entities to delay their transition to the new standards. A disproportionate 93% majority of private companies and 86% of government organizations say their teams are already stretched thin, making lease accounting even more overwhelming. Meanwhile, nearly 40% of private companies reported that avoiding employee burnout is a top concern associated with maintaining proper control over their lease portfolio.

Calling in the accountants

Some accounting firms have been hearing more concerns lately from their clients about the standard. “We are definitely seeing an uptick in the number of questions coming in from our clients,” said Heather Winiarski, a shareholder at Top 100 Firm Mayer Hoffman McCann PC, in Kansas City, Missouri. “A lot of clients are starting to really get into the details, inquiring about the new leasing standard and looking at implementing software to help. It’s definitely gotten a lot busier in the last few months.”

Among the issues for clients is identifying all the contracts that could be considered leases under the new standard. “A lot of the challenges that they’re facing is trying to make sure that they’re identifying all of the contracts that may be leases, getting the full listing of the population, and then once they’ve identified that population, identifying the discount rate that needs to be used to do the accounting,” said Winiarski. “There is a practical expedient to allow lessees to use a risk-free rate, so companies are evaluating if they’re going to use that or if they’re going to determine the incremental borrowing rate for their leases. There’s a discussion around that, and then evaluating if they’re going to be identifying and purchasing accounting software to do the lease accounting, or if they’re going to use spreadsheet software.”

The new standard is giving companies a fresh look at their leases and the various risks. “The silver lining is that the new standards are providing companies with the opportunity to prioritize lease management to not only achieve lease accounting compliance, but also to make stronger business decisions and better manage risk,” Betesh said in a statement.

Some of the risks associated with not implementing a proper lease management strategy cited by the study include:

- An unnecessarily complex lease accounting process that relies on manual effort;

- A failed annual audit due to incomplete and inaccurate lease data, potentially resulting in increased fees, damaged credibility and diminished credit; and,

- The inability to pivot and address new business needs due to a lack of visibility into important lease details.

The overall standard and the various amendments from FASB introduce extra complexities. “There’s a lot of nuances to the standard and a lot of schedules to maintain,” said Winiarski. “For a lessee, you’ve got a schedule to maintain for the liabilities as well as the assets, and then the quantitative disclosures that summarize all of this. A lot of companies are finding it easier to have a piece of software to track that and to handle the modification accounting.”

Companies often need to generate new journal entries to track the various lease modifications and tenant improvements.

“We’re finding a lot of clients that have a lot of improvements in their lease agreements and new agreements that are being entered into,” said Winiarski. “It seems like there’s been a lot more accounting where lessees have been involved in more than the normal tenant improvements, so we’ve been evaluating whether or not a client is involved in construction and the accounting related to that.”

By implementing a centralized system, companies have been automating the process and reducing some of the risks, but many companies are still trying to get their arms around all the changes.

“Companies are still figuring out how much time it’s taking to implement the new standard,” said Winiarski. “As they’re getting into the project, evaluating the software and how many leases they have, there’s still some surprise about how long it’s taking to go through the full implementation and adoption of the standard.”

Embedded leases can be hidden within contracts and need to be accounted for properly. “One of the items that companies are looking at is trying to make sure they have the full population of their leases, so if they’ve got a service contract, is there an embedded lease inside of it?” said Winiarski. “If they’re receiving a service, and there’s a piece of equipment they use to provide that service, is that equipment really an embedded lease that needs to be accounted for with the new leasing standard?”

Accountants will need to use their professional judgment to help their clients and companies. “There are a lot of estimates and judgments in the standard that companies have to work through and figure out the processes around them,” said Winiarski. “The discount rate can change the lease classification and is an important input. It not only affects what the lease liability and the right of use asset can be, but it also can impact what the lease classification is, which impacts the income statement as well. I’m excited to see companies working on it now and can’t wait until the end of the year.”